ISLAMIC MEDIUM TERM NOTES UNDER THE ISLAMIC MEDIUM TERM NOTES PROGRAMME OF UP TO RM550.0 MILLION IN NOMINAL VALUE BASED ON SHARIAH PRINCIPLE OF MURABAHAH (VIA TAWARRUQ ARRANGEMENT) UNDER THE SECURITIES COMMISSION MALAYSIA'S SUSTAINABLE AND RESPONSIBLE INVESTMENT SUKUK FRAMEWORK ("SRI SUKUK MURABAHAH PROGRAMME")

PRINCIPAL ADVISER, LEAD ARRANGER AND LEAD MANAGER: MAYBANK INVESTMENT BANK BERHAD (Company No. 15938-H)

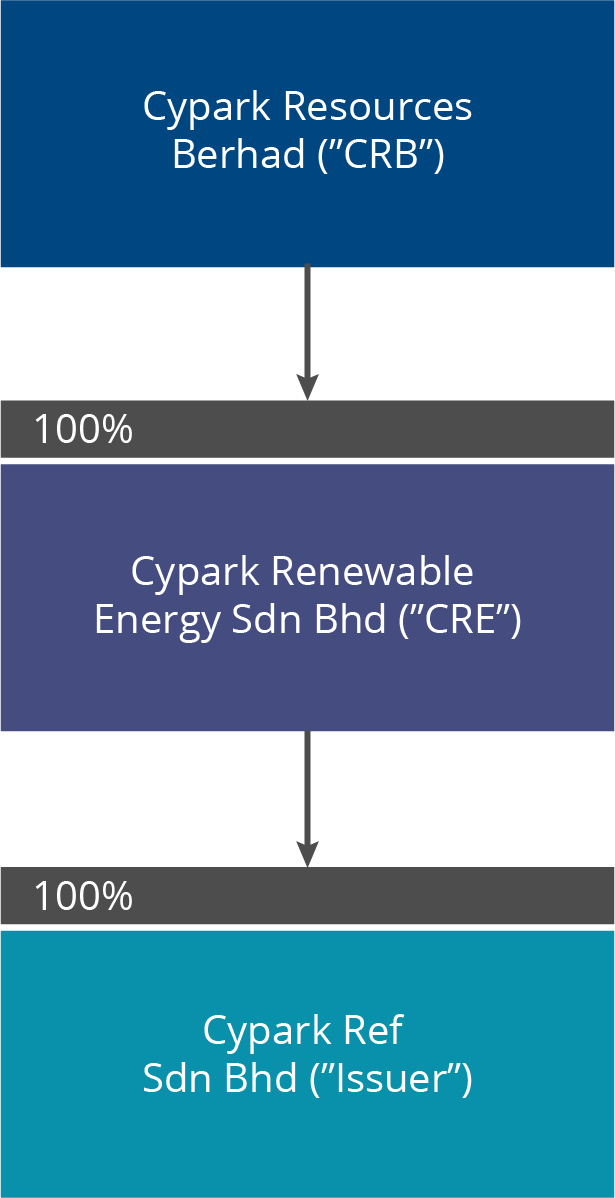

The Issuer, Cypark Ref Sdn Bhd ("CREF") is a limited liability private company incorporated in Malaysia on 12 July 2018 under the Companies Act. The Issuer is a wholly-owned subsidiary of Cypark Resources Bhd ("CRB") through its 100% shareholding in Cypark Renewable Energy Sdn Bhd ("CRE") which is the sole shareholder of the Issuer.

The main purpose of its incorporation is to be the funding conduit or special purpose vehicle for the purpose of financing the Eligible SRI Projects via turnkey financing.

The structure of shareholding of the Issuer is illustrated in the diagram below:

The Eligible SRI Projects consist of three (3) Power Plants located in Peninsular Malaysia.

| Project Companies | Project | Location |

|---|---|---|

| Cypark Estuary Solar Sdn Bhd | 30MWac floating power plant | Danau Tok Uban, Kelantan |

| Cove Suria Sdn Bhd | 30MWac floating power plant | Danau Tok Uban, Kelantan |

| Viva Solar Sdn Bhd | 30MWac ground-mounted power plant | Sik, Kedah |

The Eligible SRI Projects will be funded by way of turnkey financing from the Issuer. The Issuer has entered into a lump sum, fixed price Turnkey Contract with each of the Project Companies where the Issuer acts as the Turnkey Contractor responsible for the construction and development of the Eligible SRI Projects and in return, receives deferred turnkey payments from the Project Companies upon Commercial Operation Date, when the Project Companies receive Energy Payments from TNB. The Issuer has also entered into a back-to-back EPC Contract with CRE, the main EPC Contractor, for each of the Eligible SRI Projects.

On 1 Jan 2022, the project located at Sik, Kedah had achieved its Commercial Operation Date and started to generate electricity and sell the energy generated to TNB.

On 7 Jan 2025, the project located at Danau Tok Uban, Kelantan owned by Cypark Estuary Solar Sdn Bhd had also achieved its Commercial Operation Date and started to generate electricity and sell the energy generated to TNB.

The utilisation of proceeds are as follows:

| As at 31 Dec 2024 | Nominal value (RM million) |

Amount utilized for Eligible SRI Projects (RM million) |

Unutilized amount placed in Islamic Money Market/Fixed Deposit (RM million) |

|---|---|---|---|

| SRI Sukuk Murabahah | 550.00 | 550.00 | - |

*Note: RM80.00 million out of RM550.00 million SRI Sukuk was utilised to pay off a bridging loan which was earlier issued to facilitate the commencement of LSS2 solar projects prior to the completion of the issuance of that SRI Sukuk.

SEDA CO2 Avoidance at Sik, Kedah

| SEDA | |||

|---|---|---|---|

| Duration | kWh | MWh | CO2 Avoidance (0.639 tCO2/MWh) |

| From Nov. 21 - Oct. 22 | 48,417,090.61 | 48,417.09 | 30,938.52 |

| From Nov. 22 - Oct. 23 | 61,984,778.50 | 61,984.78 | 39,608.27 |

| From Nov. 23 - Dec. 23 | 7,779,274.50 | 7,779.27 | 4,970.96 |

| From Jan. 24 - Dec. 24 | 63,718,090.00 | 63,718.09 | 40,715.86 |

| TOTAL | 181,899,233.61 | 181,899.23 | 116,233.61 |